Maybank Premier clients are required to maintain a minimum of:

- MYR250,000 in Investable Assets (Deposits and/or Investments), OR

- MYR1 million in Total Financial Assets (Deposits/Investment and/or Loans) with Maybank

What you can look forward to as a Maybank Premier client?

Turn transactions into higher yields. Get up to 3.00% p.a. on your Private Banking Account/-i (PBA/PBA-i) with qualifying product/service usage.

Campaign Period: 1st November 2024 – 30th April 2025

Need Assistance?

Contact your Relationship Manager or email us at premierwealth@maybank.com.my

Save & Multiply With Participating Account |

|

DEPOSIT GROWTH PRE-REQUISITE: TOP UP YOUR FUNDS1 Private Banking Account (PBA) / Private Banking Account-i (PBA-i) |

|

+ |

|

PERFORM TRANSACTIONS WITH ANY OF THESE FEATURED PRODUCTS/SERVICES TO EARN HIGHER INTEREST/INDICATIVE PROFIT RATES: Fixed Savings in PBA/PBA-i2 Credit Card/-i Spend3 Debit Card Spend4 New e-Fixed Deposit/-i or e-General Investment Account-i Placement5 |

|

|

1 Product/Service PBA/PBA-i: Up to 2.80% p.a. |

2 or more Products/Services PBA/PBA-i: Up to 3.00% p.a. |

EXCLUSIVELY FOR CUSTOMERS AGED 50 & ABOVE |

|

Save & multiply with your PBA/PBA-i to earn the highest interest/indicative profit rates of up to 3.00% p.a. throughout the campaign period. |

Remarks:

1Incremental monthly Average Daily Balance (ADB)* must be minimum RM20,000 to maximum RM1,000,000 with month end balance of minimum RM 20,000 for each respective month.

2Customers are only allowed to make a maximum of 2 withdrawals from the PBA/PBA-i per month, with a minimum month end balance of RM250,000.

3Cumulative Credit Card/-i spend of minimum RM10,000 for each respective month.

4Cumulative Debit Card Spend of minimum RM1,000 for each respective month.

5New e-Fixed Deposit/-i or e-General Investment Account-i with minimum RM10,000 placement for each respective month.

*Terms and conditions apply

● Any combination or single product of financing, deposits and investments from RM 1,000,000 & above

*Terms and Conditions apply

*Incremental Average Daily Balance (ADB) is calculated as follows:

For existing Premier customers:

ADB of the qualifying account and month during Campaign Period minus ADB in the participating account for the month of October 2024 as baseline

For new Premier customers:

ADB of the qualifying account and month during Campaign Period minus the baseline (RM0)

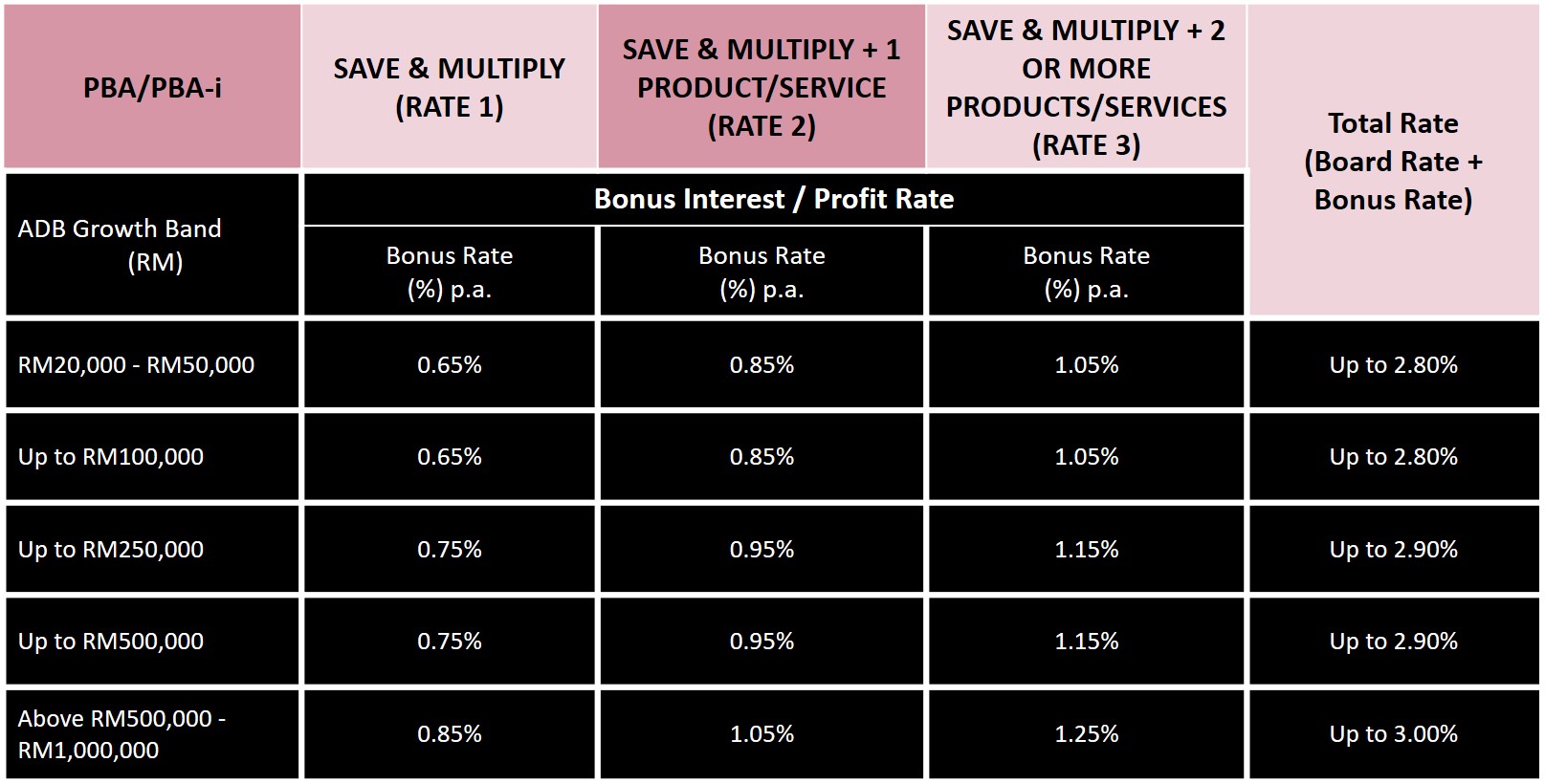

Campaign Bonus Interest/Indicative Profit Rates

Private Banking Account / Private Banking Account-i

[Effective from 01.11.2024 – 30.04.2025]

Total End Rate = Board Rate + Bonus Interest

NEED ASSISTANCE?

Contact your Relationship Manager or email premierwealth@maybank.com.my

Schedule A Branch Appointment

SAVE & MULTIPLY CAMPAIGN (1st November’24 – 30th April’25)

Click here to view the PBA Campaign Terms & Conditions EN | BM

Click here to view other Conventional participating products Campaign Terms & Conditions. EN | BM

Click here to view the PBA Campaign T&C (ENG)

Click here to view the PBA-i Campaign T&C (ENG).

Click here for PIDM DIS Brochure.

● Malayan Banking Berhad/Maybank Islamic Berhad are members of PIDM.

● Private Banking Account is protected by PIDM up to RM250,000 for each depositor.

● Private Banking Account-i is not protected by PIDM.

● Private Banking Account-i Indicative Profit Rates and Profit Sharing Ratio are declared on a monthly basis on Maybank2u website.

● The Board Rate/Indicative Profit Rate and/or Bonus Interest/Profit may be revised accordingly to reflect the changes of the Overnight Policy Rate (OPR) set by Bank Negara Malaysia.

Your journey to dedicated banking starts here.

For the best browsing experience, we recommend you view this website in the latest versions of Chrome, Firefox, Safari or Internet Explorer.