Become a Premier Wealth Client with deposits and/or investments of S$300,000 or more with us.

Click here to get started with Maybank Premier >

What is Life Insurance?

Insurance is a legal contract between two parties - the insurance company (insurer) and the policyholder, wherein the insurance company promises to compensate for financial losses due to insured contingencies in return for the premiums paid by the insured individual. In simple words, insurance is a risk transfer mechanism, where you transfer your risk to the insurance company and get the cover for financial loss that you may face due to unforeseen events.

Insurance protects you, your family and things you value from financial loss by serving as a financial safety net in the event of mishap.

How does Life Insurance work?

All insurance plans operate on premiums, which pay for different types and degrees of financial protection based on different risk profiles. In the event of insured mishap, your policy pays out a predetermined sum of money to you and your loved ones.

Some plans also offer add-ons or riders that allow you to enhance your protection, from critical illness protection to payment waivers that can waive your premiums under insured circumstances. In addition, insurance savings plans offer individuals an opportunity to save, invest and accumulate funds to meet their needs in future.

Types of Life Insurance

Whole Life Insurance

Whole life plans provide life-long protection and a payout upon death or Total and Permanent Disability (if applicable). Besides protection, whole life insurance is suitable for long-term savings and comes with surrender value.

Term Insurance

Term insurance protects you for a fixed term and provides a payout upon death or Total and Permanent Disability (if applicable) during this period. Term insurance does not have any surrender value.

Endowment Insurance

Endowment insurance provides a savings component on top of protection and pays out a lump sum with cash bonuses upon policy maturity, or upon death or total and permanent disability (if applicable) during the policy term.

Critical Illness Insurance

Critical illness insurance pays a lump sum upon diagnosis of medical conditions such as Major Cancers, Heart Attack of Specified Severity and Stroke.

Investment-linked Insurance

Investment-linked policies (ILPs) offer flexibility of protection and investment in one plan as you decide on the amount of premiums used to purchase units in each component. You may choose different ILP funds to invest into depending on your risk profile.

Universal Life Insurance

Universal life is commonly used for legacy planning as it offers life long protection against death. This plan also provides the opportunity to build cash values through its crediting rates; guaranteed and projected, and offers one the flexibility of making a withdrawal when needed. There are also other types of universal life insurance which provide low death coverage and focus on wealth accumulation. These could be for whole of life or for a limited term.

Life Annuity

A life annuity provides a regular payout and can serve as retirement income. Premiums are usually paid in a lump sum and you may select the age for the payouts to commence.

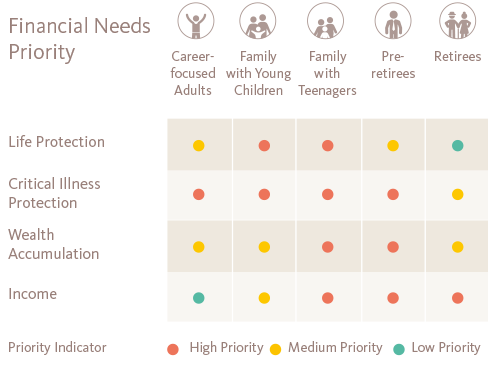

Insurance needs change at every life stage. Getting the suitable insurance at different life stages can help you achieve your goals and safeguard your family’s future. Visit https://www.lia.org.sg/tools-and-resources/consumer-guides/2020/your-guide-to-life-insurance/ for details.

Key Benefits of Insurance

Risk mitigation / Protection from unforeseen events

Insurance provides a lump sum payout to you and your loved ones in the event of mishaps such as accidents, critical illnesses, death and/ or Total and Permanent Disability.

Wealth accumulation / Regular income

Endowment insurance provides returns on your funds with a lump sum maturity payout. Some plans also offer you regular income in the form of guaranteed yearly cash benefits or annuities.

Coverage for unexpected expenses

In the event of accidental injuries or hospitalisation, insurance reimburses you for your incurred medical expenses and/or loss of income.

Key Risks of Insurance

Liquidity Risk

Surrendering your policy before maturity can incur large penalties. Before purchasing your policy, ensure you have a stable means of paying premiums.

Market Risk

With endowment insurance plans and ILPs that have a savings element in which premiums are invested, returns sometimes rely on market conditions. In the event of downturn, you may receive a lower surrender or maturity value.

FAQ

Q: What insurance do I need?

A: Fundamental types of insurance for you include medical insurance, disability insurance, critical illness insurance, whole life insurance and personal accident plan.

Q: When should I start purchasing insurance?

A: The earlier, the better. Age can raise your premiums, since older individuals are at higher risk of developing health conditions. For this reason, insurance plans are best purchased in youth and good health to take advantage of lower premiums.

The information on this site is prepared by Maybank and Etiqa Insurance for information purposes and should not be construed as an offer to sell, recommend or solicit the purchase of any insurance products. Maybank makes no representation and/or warranty as to the accuracy or completeness of this information and is not liable for any errors or omissions in the content of this site, nor shall it be liable for any losses arising out of any person's reliance upon this information. This advertisement has not been reviewed by the Monetary Authority of Singapore. Any information contained on this site is subject to change at any time, without prior notice.

Warning : You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase a product. In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should carefully consider whether the product is suitable for you.