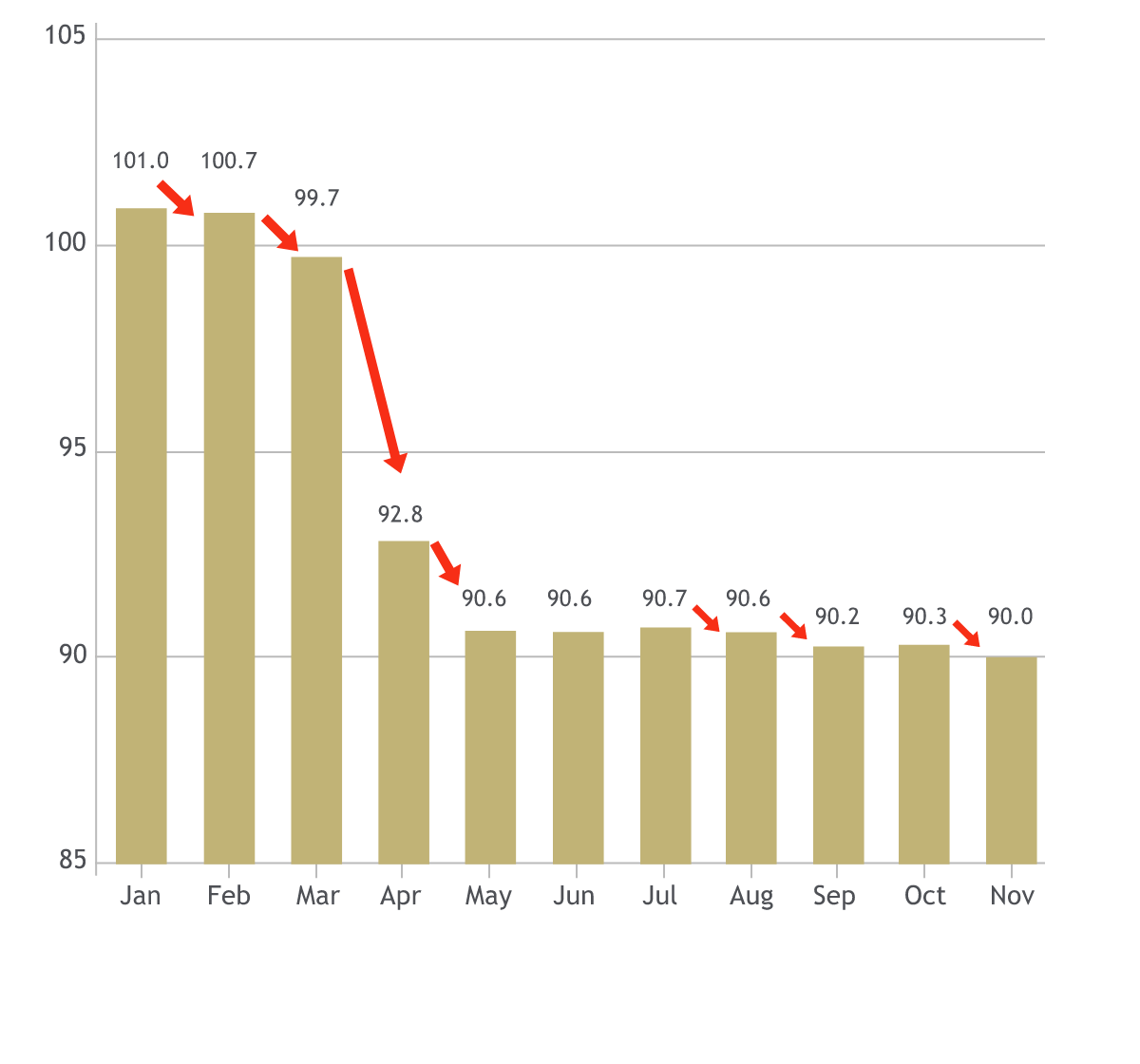

OPEC’s 2020 global oil demand forecasts (in million barrels per day)

Source: OPEC Secretariat I 11 November 2020

Oil was among the worst-performing asset classes in 2020. The jaw-dropping event was that the price on futures contract for West Texas crude fell below zero for the first time in history to as low as negative USD 40.32 per barrel in April 2020. The extreme move was a reflection of how oversupplied the oil market had become as global economic activities ground to a halt following the rapid spread of the COVID-19 pandemic. The situation was also exacerbated by a price war between Saudi Arabia and Russia, as well as a lack of immediate storage space for the excess oil inventory.

Having said that, the gradual reopening of economies has led to the rebound of oil prices from the historical low levels. However, challenges remain which will likely keep a lid on prices in 2021. The Organisation of the Petroleum Exporting Countries (OPEC) has lowered its 2020 global oil demand forecast for the seventh time last year as the speed of recovery in economic activities remained sluggish. In its November monthly report, OPEC projected global oil demand to decline to 90.01 million barrels per day (mb/d) in 2020, down from 99.79 mb/d in 2019. Global oil demand forecast for 2021 was also revised down to 96.26 mb/d from prior forecast of 96.84 mb/d.

OPEC believes the negative impact from COVID-19 on oil demand will likely persist through the first half of 2021. Hence, the demand recovery is going to be more back-end loaded. Notably, global oil demand is unlikely to return back to its pre-pandemic levels of about 100 mb/d. Given the absence of a sustainable demand growth backdrop, we see a low probability of a renewed bull market in oil prices in the foreseeable future.

In addition, the movement towards using clean energy would weigh further on the future of oil demand. As aptly captured in BP Plc’s latest Energy Outlook, we might have already seen a peak in global oil demand even under a business-as-usual scenario post-pandemic.

As at end-November, the price structure of the three main futures markets (ICE Brent, NYMEX West Texas Intermediate and DME Oman) were in a sustained contango (i.e. futures prices are higher than spot prices) amid renewed concerns about the recovery of global oil demand and the oil supply increase from OPEC and its allies (OPEC+) from January 2021.

Notably, the current 7.7 mb/d production cut accord is expected to shrink by 500,000 b/d to 7.2 mb/d in January 2021. OPEC+ will hold monthly meetings to decide if similar amounts will be reduced in the following three months. If the production cuts were reduced to 5.7 mb/d from April 2021, the excess oil inventories built over the first half of 2020 may be only drained in 2H 2022. Nevertheless, should OPEC+ refrain from reducing the output cuts, the excess oil inventories could be drained by end-2021 or early 2022.

Overall, we believe the oil market may have passed the worst of the crisis and a weaker USD could lend some support to prices of commodities including oil in 2021. That said, given the above-mentioned headwinds, we are neutral on oil and expect oil prices to remain range-bound for the year. In particular, we project Brent prices to average around USD 40-45 per barrel in 2021.