While the risks of geopolitical tensions, unpredictability of the COVID-19 pandemic and rising credit excesses remain, China’s continued economic recovery, coupled with supportive fiscal and monetary policies should

provide a conducive environment for Chinese corporate earnings and consequently the stock market. Notably, China’s corporate earnings are projected to rebound from -2.3% in 2020 to +19.1% in 2021, led by the Consumer

Discretionary and Communications Services sectors. We expect these sectors to be supported by both government policies and sector-specific growth opportunities. In addition, we also see attractive value in the Industrial

and Insurance sectors with both projected to post robust earnings growth in 2021.

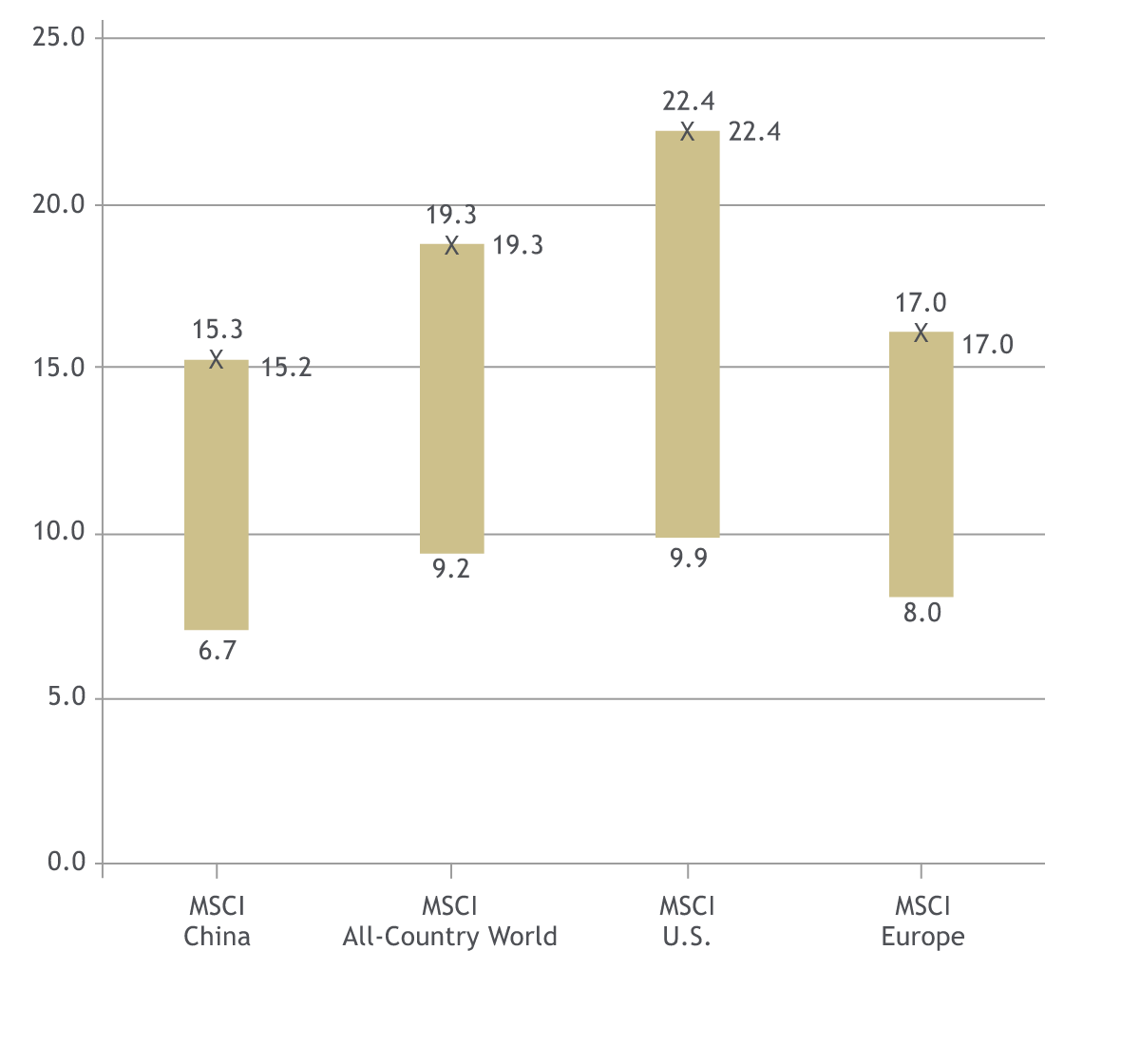

A potential headwind though for Chinese equities may be the rising valuation. Chinese stocks are no longer as cheap relative to the historical valuation range after the strong rally in 2020. Notably, MSCI China is

trading at 2021 price-to-earnings ratio of 15.2x, the highest level since 2009. Nevertheless, the market still looks undemanding when compared to global peers’ average of 19.3x.