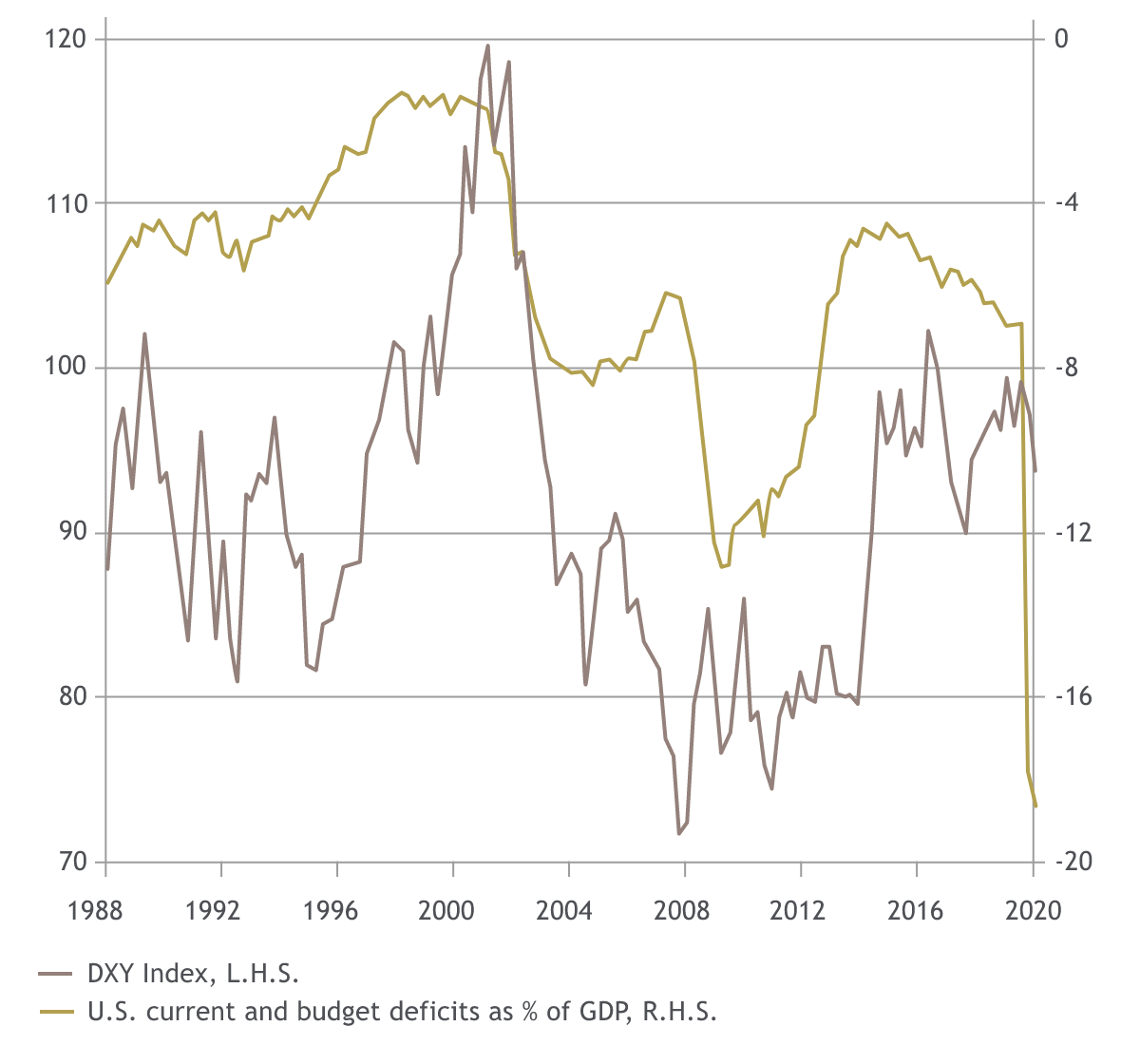

2020 was a year of global health catastrophes and historic economic hardship. Into 2021, we look for healing, in particular in the second half of the year. Differentiated crisis management (COVID-19 control, vaccine availability and adoption), fiscal management prowess and monetary policies will give rise to a differentiated pace of recovery across economies, providing opportunities for currency interplays. Unprecedented fiscal and monetary support was rendered to economies but there are increasing concerns that economic scarring could result in lower business investment, damage long-term productivity and cause macro inefficiencies in the interim. Central banks are thus hard-pressed to prevent rates from rising lest any further shocks derail the nascent recovery.

Home