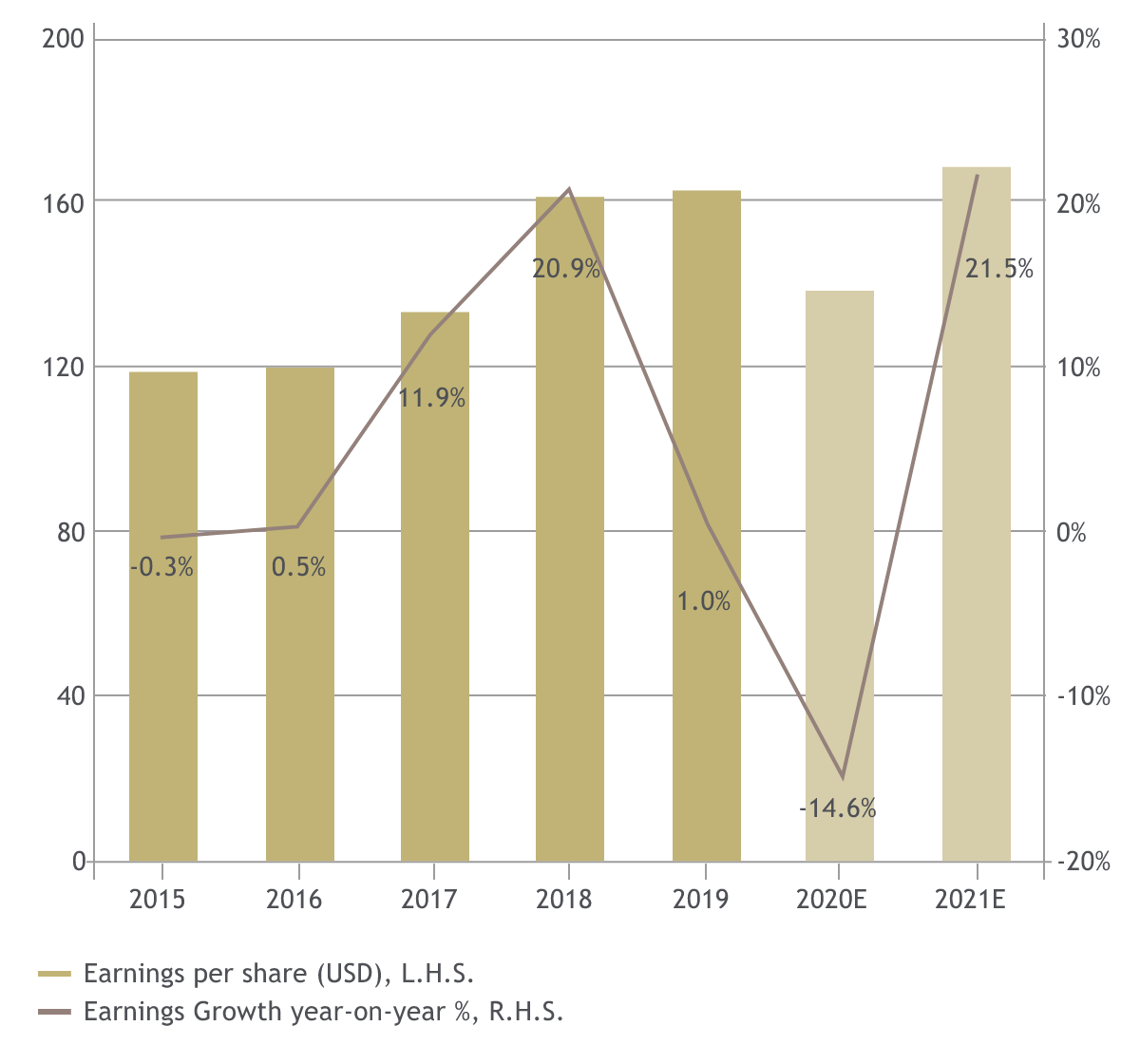

Given the gradual improvement in macro outlook, STOXX Europe 600 (SXXP) earnings are projected to rebound to pre-pandemic levels by end-2021 after the estimated 35% decline in 2020. While European stocks have witnessed

some support with increased optimism on a broader economic recovery, the positives may have been priced-in with the market having rebounded more than 30% from the bottom in March 2020.

Notably, SXXP is trading at more than one standard deviation above historical average valuation based on consensus forward price-to-earnings ratio.

In addition, there is potential for near-term earnings disappointment in view of the re-imposed lockdown restrictions in selected European cities. A less optimistic management guidance could also lead to renewed downward

earnings revision pressure, particularly for the more economically-sensitive cyclical sectors. Coupled with the stretched market valuation, the risk-reward for European equities appear unattractive at current juncture.

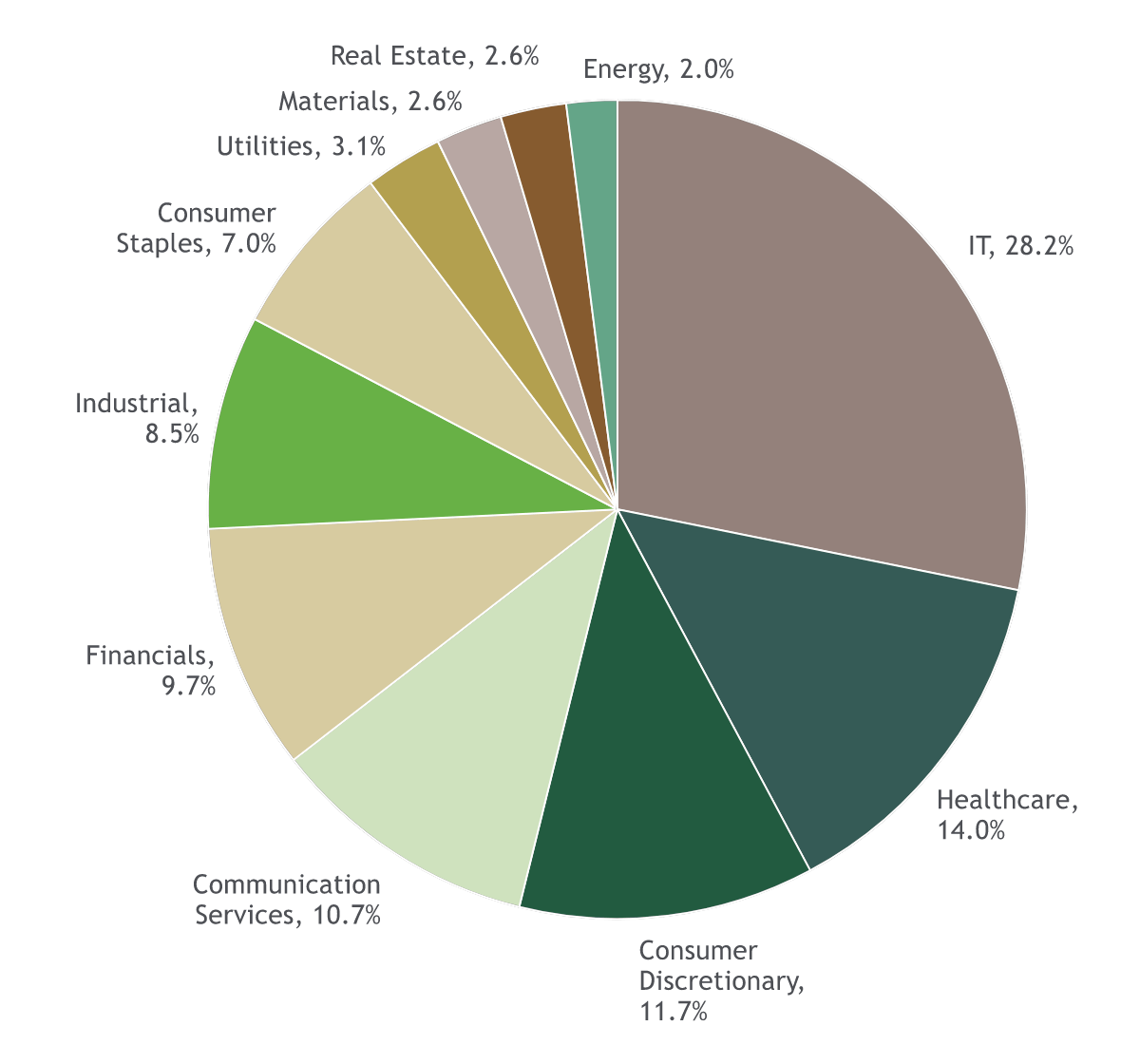

Longer-term, European equities could continue to lag the global markets given the much lower exposure to secular technology growth. The information technology (IT) sector accounts for less than 10% of SXXP’s index

weighting, which is much lower when compared to IT’s representation in MSCI AC World. In fact, the market has rarely outperformed global peers since the global financial crisis in 2008. As we expect the focus on technology

and digitalisation to sustain even after the COVID-19 pandemic woes, European stocks may remain marginalised against their global peers.