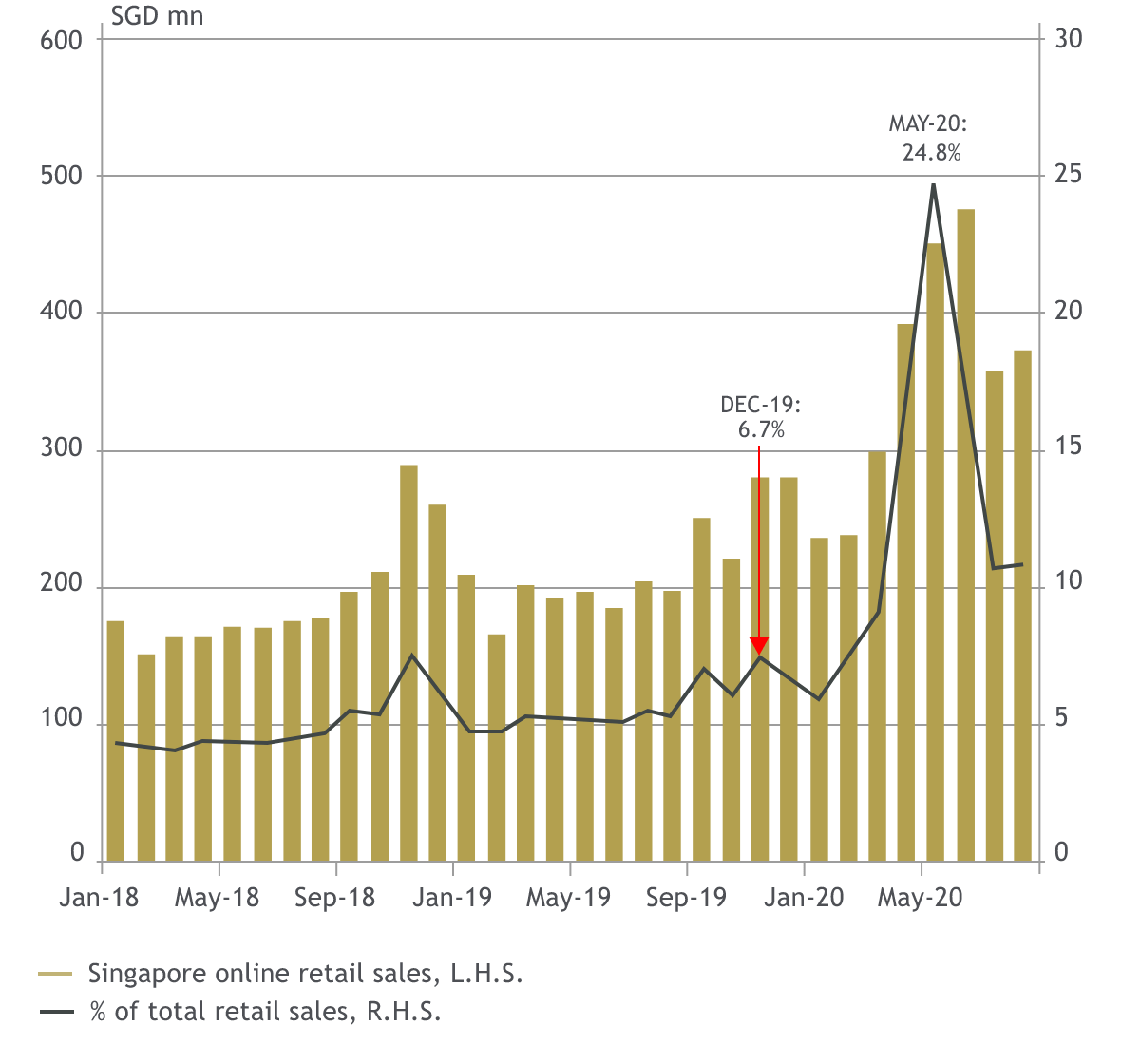

First, the pandemic has accelerated digitalisation and the growth of e-commerce. Singapore’s share of online sales has jumped permanently higher, boosting the use of digital payments and a shift away from cash. Japan, a

heavily cash-based economy, saw a dramatic shift to digital payment because of the fear of handling physical cash.

Second, the proportion of “work from home” workers post-pandemic will be higher. This may even be productivity-enhancing as workers waste less time and energy commuting, while firms save costs from smaller office spaces.

Third, stricter border controls will persist even after the pandemic is over, changing the future of air travel. Virus tests at airports will increase travel costs and time. Many of us will travel less frequently for

business, as cheap zoom video calls substitute the need for in-person meetings. Tourism will take longer to recover as a vaccine may not completely eradicate the virus.